Invoice vs Receipt: What’s the Difference

An invoice is a payment request, while a receipt is a document for payment that has already occurred. Businesses frequently use invoices after providing a service to notify the customer of the expected payment. Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.

Information provided on a Receipt

The information they contain, the way you create them, and how they’re issued can all affect your business accounting. With an effective receipt creation and management system, you can stay on top of financial records and stay compliant with Canada Revenue Agency (CRA) tax rules. A receipts and payments account only contains records of transactions related to cash and bank. One of the main reasons receipts and invoices are important for all businesses is that they allow for complete and accurate recordkeeping. As receipts and invoices flow towards a business, the owner or bookkeeper will need to add their costs to their running totals for the month and year. This allows the business to maintain a clear overview of its expenses to date.

What kind of receipts can I use for taxes?

There are various types of receipts, including cash receipts, sales receipts, rent receipts, and payment receipts, each tailored to different financial scenarios. It is essential to differentiate receipts from invoices, as invoices are issued before payment as a request for payment, while receipts are provided after payment as proof of completion. Receipts play a crucial role in the field of accounting, serving as tangible proof of financial transactions. Whether it’s a simple cash purchase or a complex business transaction, a receipt acts as evidence that a payment has been made or received. In the world of finance, receipts are integral in maintaining accurate records and ensuring the transparency of financial activities.

- Keeping and storing your receipts in an organized way can help you maintain a record of transactions should they ever be called into question.

- A credit card receipt is a receipt that details a transaction that was made using a credit card.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- You should receive two copies of your cash receipts, one for you and one for the customer.

Related Term or Concept 3: Audit Trail

Accounting stamps are an ideal way to take care of legibility, as these provide the most important information at a glance. This makes it substantially easier to file the documents correctly at the end of the month. However, it is relatively common to verify small amounts of change using reissued receipts – for example, tips, postage, parking fees, etc. As reissued receipts are handled internally within a company, they do not count as an internal document because they have a special status as a third type of receipt. Where the document originated from is the deciding factor in what constitutes an external financial statement and what is an internal financial statement. For example, with online banking statements, even if the company prints out the statement itself, it is still an external document, as it was created and provided by an external party.

Grow Your Business With QuickBooks Intuit!

These software programs can save businesses time and effort by automating the receipt creation process and ensuring accuracy in financial record-keeping. Using a receipt template can save receipt in accounting businesses time and ensure that all necessary information is included on the receipt. It also helps to ensure consistency in the look and feel of receipts across different transactions.

Who Creates a Receipt?

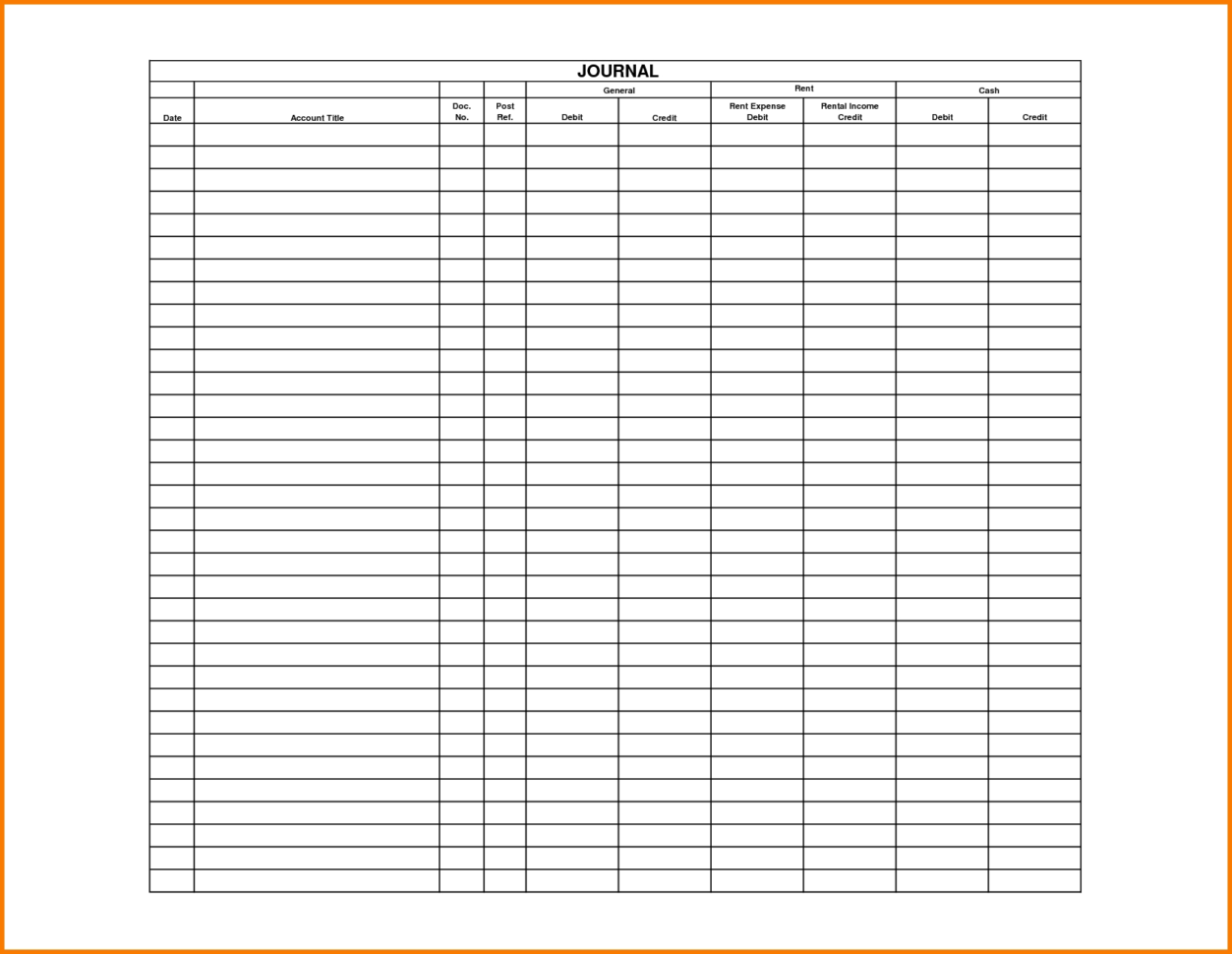

As such, the income and expenditure account is part of the double entry system, while the receipts and payments account is not. First, a receipts and payments account shows total receipts and total payments under different headings. The account provides classified records of different heads of receipts and payments.

Cash receipts can come from the sale of goods instead of services as well. Introductions to basic accounting often identify assets, liabilities, and capital as the field’s three fundamental concepts. Assets describe an individual or company’s holdings of financial value. In its most basic sense, accounting describes the process of tracking an individual or company’s monetary transactions. Accountants record and analyze these transactions to generate an overall picture of their employer’s financial health. Double-entry systems add assets, liabilities, and equity to the financial tracking.

Additionally, if you are audited, you require records and keep business receipts for a minimum of three years. As a small business owner, you must save copies of customer receipts since they serve as records. Businesses must account for overhead carefully, as it has a significant impact on price-point decisions regarding a company’s products and services.

Electronic or digital receipt in accounting is a document in which the payer instructs his or her bank to transfer money. Digital receipts are analogous to paper receipts, but they are issued electronically. On a regular receipt, the payer puts his or her electronic signature. Still, here it is a code (a sequence of one or more specific characters), which is analogous to the traditional.